Pay Per Lead (PPL) vs. Cost Per Acquisition (CPA)

Pay Per Lead vs. Cost Per Acquisition

Understanding Pay Per Lead (PPL) and Cost Per Acquisition (CPA) is crucial for optimizing ROI from leads. Both models offer unique advantages, and many businesses employ a combination of PPL and CPA at different stages of the funnel or across channels. Below is a concise comparison of each model, followed by links to two detailed, role‑specific guides:

-

“PPL and CPA for Lead Sellers”—deep dive on packaging and distributing leads profitably.

-

“PPL and CPA for Lead Buyers”—detailed tactics for choosing and optimizing based on your sales operations.

What Are PPL and CPA?

-

Pay Per Lead (PPL): The buyer pays a fixed fee for each qualified prospect (e.g., a form submission or call). The seller generates leads; the buyer's team handles follow-up and conversion.

-

Cost Per Acquisition (CPA): The buyer pays only when a prospect becomes a customer (e.g., completes a purchase or signs a contract). The seller assumes full conversion risk.

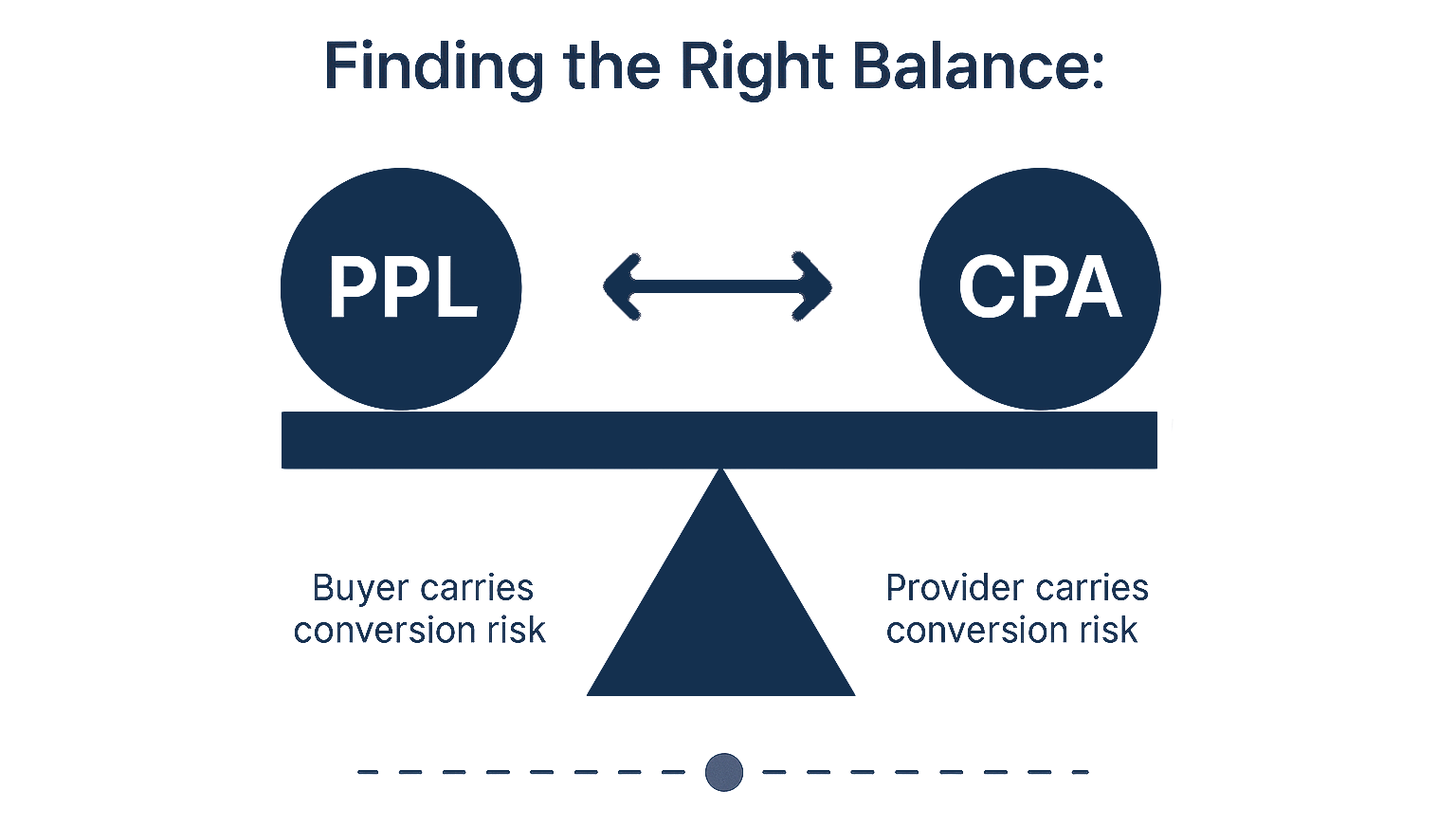

Both models align incentives differently: PPL shifts conversion risk to the buyer, while CPA shifts it to the seller.

Core Trade‑Offs

| Aspect | Pay Per Lead (PPL) | Cost Per Acquisition (CPA) |

|---|---|---|

| Conversion Risk | Conversion responsibility lies downstream, so effective cost per customer depends on lead-to-sale rates. | Converting prospects into customers is the provider’s responsibility; payment is made only upon successful acquisition. |

| Cost Transparency | Cost per lead is fixed, but actual cost per customer varies based on conversion rate. | Cost per customer is fixed and known upfront, though the cost to generate each lead is not specified. |

| Control Over Quality | Lead quality can vary by source, requiring vetting to maintain intent. | Incentives are aligned with successful conversions, promoting consistent lead quality. |

| Budget Flexibility | Lead volume and spend can be scaled rapidly by month or season. | Often involves commitments to minimum acquisition volumes or per-customer rates, which may limit short-term adjustments. |

A simplified scale shows PPL and CPA in perfect equilibrium, reminding marketers that the healthiest customer-acquisition engines spread conversion risk, and budget, across both models.

Quick Pros & Cons

Pay Per Lead (PPL)

Pros:

-

Predictable fee per lead for sellers, ensuring steady revenue when demand is consistent.

-

Buyers can scale lead volume and budget flexibly each month or seasonally without long-term commitments.

-

Sellers have an incentive to deliver qualified prospects; buyers retain control over qualification standards and messaging.

Cons:

-

Buyers face potential increases in cost per customer if conversion rates drop, since they pay per lead regardless of outcome.

-

Sellers must maintain rigorous vetting and verification processes (e.g., phone/email validation) to preserve lead quality or risk buyer dissatisfaction.

-

Both parties bear some risk: buyers manage follow-up and conversion, while sellers invest in lead generation costs upfront without guaranteed conversion.

Cost Per Acquisition (CPA)

Pros:

-

Sellers receive payment only when a prospect becomes a customer, aligning incentives to focus on high-intent leads and conversion optimization.

-

Buyers benefit from a fixed customer acquisition cost (CAC), simplifying budgeting and reducing wasted spend on non‑converting leads.

-

Sellers manage end-to-end nurturing and qualification, easing the burden on buyers with limited sales resources.

Cons:

-

Sellers assume full conversion risk and cover lead generation and nurturing costs if a prospect does not convert, which can strain cash flow.

-

Buyers may face higher per-customer fees because conversion costs are bundled into the CPA rate.

-

Both parties have less transparency into early-stage metrics: buyers see only cost per customer, and sellers must balance volume commitments with conversion targets to maintain profitability.

Role‑Specific Considerations

For Lead Sellers:

-

Define clear qualification criteria—demographic, intent, and project timelines—to match buyer needs.

-

Establish tiered pricing that reflects lead quality, urgency, and exclusivity.

-

Implement verification processes (phone/email) to minimize invalid or duplicate submissions.

-

Maintain transparent dashboards showing lead delivery, status updates, and buyer feedback.

-

Track performance against benchmarks (e.g., conversion rates, refund/churn metrics) and adjust pricing or targeting accordingly.

For Lead Buyers:

-

Compare PPL and CPA offers by assessing your sales team’s capacity to follow up and convert.

-

Calculate true CAC by combining lead costs with internal follow‑up expenses and conversion rates.

-

Allocate budget across PPL and CPA channels based on goals—e.g., use PPL for volume during peak seasons, CPA for efficient budget use when ramping new products.

-

Develop a standardized follow‑up playbook: immediate response (under 5 minutes), multi‑channel outreach (call, email, SMS), and lead nurturing sequences.

-

Monitor vendor performance via SLA metrics: lead-to‑customer conversion, refund or churn rates, and long‑term customer value.

Related Resources

PPL and CPA each play strategic roles in a balanced marketing mix. By understanding how they distribute risk, control costs, and impact lead quality, organizations of any size can apply the right combination to meet their growth objectives.

Perspective from Practice

This article reflects working with lead programs where Pay Per Lead and Cost Per Acquisition are not abstract pricing models, but operating choices that shape risk, cash flow, and buyer relationships. In practice, most breakdowns occur when teams select a model without aligning it to their follow-up capacity, data quality, or ability to absorb conversion variability.

At ClickPoint Software, we see this dynamic daily through LeadExec, which is used by both lead sellers and buyers operating under PPL, CPA, or hybrid arrangements. Sellers often underestimate the operational discipline required for CPA, while buyers sometimes overestimate their ability to consistently convert PPL volume.

LeadExec is designed to support both models by preserving lead context, qualification data, delivery timing, and outcomes at the transaction level. This allows teams to measure true performance rather than rely on assumptions. Over time, the most resilient programs use PPL and CPA together, allocating risk based on channel, seasonality, and sales capacity rather than treating one model as universally superior.

The core lesson is structural. PPL and CPA are tools, not strategies. Long-term success stems from aligning the pricing model with the actual process of generating, following up on, and converting leads in real-world conditions.

Frequently Asked Questions

What is the main difference between Pay Per Lead and Cost Per Acquisition?

Pay Per Lead charges the buyer for each qualified prospect delivered, while Cost Per Acquisition charges only when a prospect becomes a customer. The key difference lies in where conversion risk is located.

Which model carries more risk for the seller?

CPA carries more risk for the seller because payment depends entirely on successful conversion. PPL allows sellers to recover costs earlier but requires maintaining lead quality.

Which model carries more risk for the buyer?

PPL carries more risk for the buyer because conversion performance depends on their sales process, follow-up speed, and sales effectiveness.

Is PPL or CPA better for lead sellers?

Neither is universally better. PPL offers more predictable cash flow, while CPA can produce higher long-term margins if conversion rates are strong and consistent.

Is PPL or CPA better for lead buyers?

It depends on sales capacity. Buyers with strong, fast follow-up teams often prefer PPL. Buyers with limited sales infrastructure may favor CPA for cost certainty.

Why do many companies use both PPL and CPA?

Using both allows teams to spread risk. PPL is often used for volume and testing, while CPA is used for efficiency, new products, or constrained budgets.

How should lead quality be handled differently in PPL vs CPA?

In PPL, buyers typically enforce stricter qualification and refund rules. In CPA, sellers invest more heavily in verification, nurturing, and optimization to protect margins.

How can performance be measured accurately across both models?

Teams should track lead-to-sale conversion rates, effective cost per customer, refund or churn rates, and follow-up timing, rather than relying solely on list prices.

How does LeadExec support PPL and CPA programs?

LeadExec tracks lead intake, qualification signals, routing decisions, delivery timing, and outcomes, enabling both buyers and sellers to evaluate performance across various pricing models consistently.

Can PPL be converted into CPA over time?

Yes. Many programs begin with PPL to establish benchmarks, then transition high-performing sources or buyers into CPA once conversion patterns are predictable.