Lead Distribution Cost Optimization to Cut Validation & Delivery Spend

Lead sellers usually evaluate performance at acquisition. It’s where budgets are set and results are easiest to compare. But leads don’t stop costing money once they’re captured. Validation, delivery, retries, and returns all affect profitability, and those costs tend to accumulate after the form submission. Segmenting leads by value and risk reduces processing costs without increasing returns.

TL;DR

Validation and delivery costs stack after capture. Many systems validate every lead the same way. Matching validation depth to lead value, preventing duplicate checks, and routing correctly before expensive validation reduces spend without increasing compliance or return risk.

Ready to cut spend without breaking coverage or compliance? Set Up Your Free Account.

The Economics of Post-Capture Lead Validation

After leads are captured, they typically go through a series of billable steps. Depending on the setup, this can include phone or email validation, TCPA consent checks, DNC screening, enrichment, and delivery attempts with retries. Each action carries a cost.

When every lead follows the same processing path regardless of price or risk, processing cost can rise without improving routing, acceptance, or price. A shared lead sold for a few dollars can be run through the same checks as a high-priced exclusive, even though the economics are very different.

Acquisition cost is easy to see when a lead is captured. After the form is submitted, it’s harder to track what happens. Phone and email validation, TCPA and DNC checks, enrichment, and delivery attempts may all be billed by different vendors. Retries and returns add additional charges.

Because those charges arrive on different invoices and at different times, the true cost of a lead after capture is harder to see unless it’s assembled in a single report.

The distribution process sits between revenue and expense. It determines how much each lead costs to handle and whether that cost makes sense given what the lead will sell for. Matching validation depth to lead value and risk, without breaking compliance or routing accuracy, lowers per-lead cost and protects margin.

How Verification Costs Stack Up

Verification costs increase when the same checks run more than once or when checks run before they are needed. For example, the same phone number can trigger validation twice when two sources submit the same lead within minutes. Each lookup is billed, even though the result does not change.

Costs also rise when checks run in the wrong order. TCPA consent verification can run before buyer coverage is known, so leads that fall outside accepted territories receive the same processing as deliverable ones. When delivery fails and retries repeat the same paid checks, additional charges are incurred without improving the outcome.

These issues stem from uniform treatment. Low-priced shared leads and high-priced exclusives do not carry the same economics or risk profile, but they are often processed the same way.

Some checks are mandatory. TCPA consent verification documents permission to contact, and DNC and litigator screening reduce known legal exposure. Beyond that baseline, additional validation improves quality, not compliance.

Running buyer coverage and routing checks before expensive validation prevents spending money on leads that will never be delivered.

Validation Depth, Risk, and Compliance

Compliance is the baseline legal requirement. TCPA consent verification documents that a consumer agreed to be contacted. DNC and litigator screening reduce known legal exposure. These checks should run consistently.

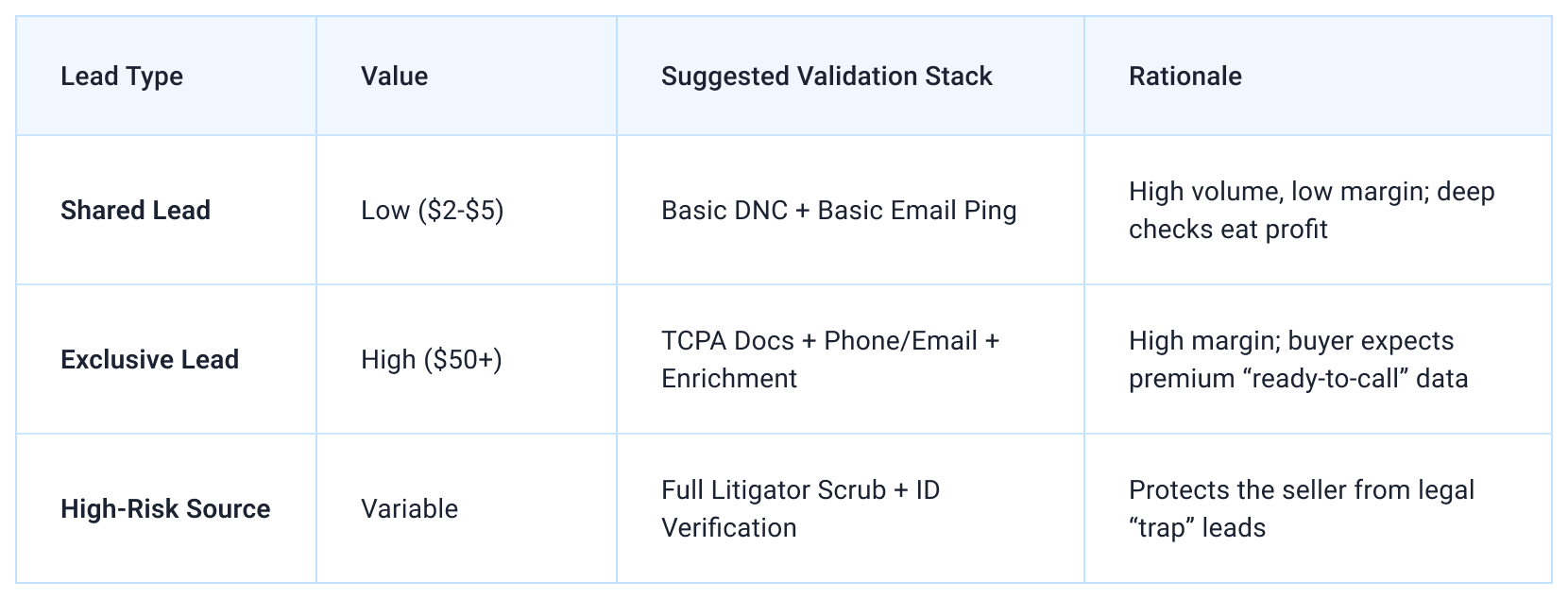

Beyond that baseline, validation depth is an economic choice. Additional enrichment can improve match rates and buyer confidence, but it carries cost. Applying the same enrichment stack to every lead assumes equal value and equal risk.

Validation depth should reflect what a buyer is likely to pay and how risky the lead looks. Source history, geo mismatches, and unusual volume all matter. Higher prices or clearer risk justify deeper checks.

Timing also affects cost. Coverage and routing should clear before higher-cost validation runs. Expensive validation or enrichment adds no value if the lead cannot be delivered to a buyer.

Retries, Providers, and Cost Mechanics

Validation and delivery costs increase when failures cause retries to repeat the same paid checks. Validation and delivery vendors use different pricing models. Some charge per request, others per successful match, and volume tiers can change over time. A retry can double cost even when it adds no new information.

Retries are part of any delivery system, but problems start when retry behavior isn’t constrained. A failed delivery can trigger another attempt, which then repeats the same validation and delivery calls. Short outages or transient failures can turn into bursts of duplicate checks that were never intended, and all of them are billable.

Controlling this comes down to how retries behave when something goes wrong. Allowing time between attempts keeps the same paid checks from firing repeatedly while a provider or endpoint is having trouble, and treating repeated attempts as the same event avoids duplicate billing. Pausing nonessential steps during failures prevents short disruptions from turning into unnecessary charges.

Quantifying Repeat Fees, Retries, and Refunds

Distribution costs are difficult to control if individual charges aren’t visible. Each validation call, delivery attempt, retry, and refund has a cost. Looking at these charges per lead makes sources of waste easier to identify.

For most mid-volume lead flows, a week of data is enough to surface repeat charges and sequencing issues. Phone and email validation, TCPA checks, DNC screening, enrichment, delivery attempts, retries, and refunds all show up as billable events. Reviewing those charges using actual provider rates, rather than blended averages, clarifies where costs accumulate.

In practice, inefficiencies arise from specific mechanisms. Duplicate validations occur when the same lead arrives from multiple sources within a short window. Phone or email validation services often charge on a per-lookup basis, with example rates ranging from fractions of a cent to a few cents per check. When those checks repeat, cost increases without changing delivery.

Some validation and delivery steps do not change routing, acceptance, or price. Identifying and removing those steps reduces unnecessary spending.

One way to make post-capture costs visible is to start from failures and work backward.

EXAMPLE:

Pull a sample of failed posts and refunds and trace the checks that preceded them. If 8% of leads triggered duplicate phone checks across multiple sources, that’s pure waste. If retries fire without idempotency, you’re paying twice for the same event.

Assign dollars to each failure path. For instance:

- Duplicate phone check: $0.012 x 2,000 occurrences = $24

- Double TCPA call on retry: $0.02 x 800 = $16

- Failed post without backoff, 3 attempts: $0.004 x 1,200 = $4.80

Small numbers add up at volume. Stack them up. Prioritize the two or three fixes that erase the most repeat spend.

When Costs Increase

Changes in validation and delivery costs often come from everyday shifts in systems and partner behavior. Provider pricing updates, retry behavior, and buyer acceptance rules all affect what gets spent per lead. The impact usually appears later, when billing reflects what actually happened.

These changes are easy to miss in real time because charges are spread across multiple systems and vendors. A small increase in retries or a pricing adjustment may not stand out on its own, but together they raise overall validation and delivery costs.

Buyer coverage changes create another source of cost increase. When buyers tighten territory or acceptance rules, more leads fail after processing has already occurred. At that point, validation and delivery charges have already been incurred. Routing precision and early coverage checks reduce fees on leads that are unlikely to be accepted.

A Practical Way to Control Distribution Costs

Validation and delivery affect profit in direct, measurable ways. Every check, retry, and delivery step either changes what happens to a lead or it doesn’t. When a step has no effect on routing, acceptance, or what the lead sells for, it adds cost without changing the result.

Validation depth works best when it reflects lead value and observable risk. Low-priced or low-risk leads do not need the same treatment as higher-priced or riskier ones. Applying lighter checks where appropriate keeps processing costs aligned with potential revenue.

The order of operations matters just as much. Coverage and routing should clear before expensive validation or enrichment runs. Leads that cannot be delivered should not move further through the flow, where additional fees are incurred without any chance of recovery.

Those same principles apply to retries and failures. Retry behavior needs limits so failed attempts do not repeat the same charges. Duplicate checks should be avoided. When systems or vendors behave unexpectedly, nonessential steps should pause instead of continuing to generate fees.

What Cost Control Looks Like in a Lead Distribution System

Cost control improves when capture, validation, routing, and delivery run in a single flow. When those steps are split across tools, duplicate checks, retries, and misroutes are hard to prevent and harder to trace back to cost.

LeadExec is lead distribution software that manages capture, validation, routing, and delivery in one system. Used this way, it allows validation depth, routing rules, and retry behavior to be applied deliberately instead of uniformly. Required compliance checks run consistently, while additional validation is applied based on lead value and buyer criteria.

This structure limits unnecessary processing. Coverage is enforced before delivery, retries are constrained so failures do not repeat paid checks, and returns tie back to specific leads and delivery attempts. Costs that do not change routing, acceptance, or price are easier to see and easier to remove.

If you want to see how these controls behave on real traffic, LeadExec can be used to test validation depth, routing order, and retry behavior directly in the delivery flow.

Lead distribution costs are shaped by what happens after capture. Validation, delivery, retries, and returns each introduce charges that affect overall profitability. When those steps are applied uniformly, costs increase without changing where leads route, whether they are accepted, or what they sell for.

Better control comes from understanding which actions actually affect routing, acceptance, and price. Running coverage checks early prevents unnecessary fees. Matching validation depth to lead value keeps processing costs in line with revenue. Managing retry behavior limits repeated charges during failures.

Taken together, these choices affect how efficiently leads move through the system. When the flow is visible and ordered deliberately, costs are easier to track and margins are easier to maintain.

Frequently Asked Questions

What costs are incurred after a lead is captured?

After capture, a lead can trigger several billable actions. These often include phone or email validation, TCPA consent verification, DNC or litigator screening, enrichment from data providers, and delivery attempts. Retries and returns can add additional charges. Each step may be billed separately, depending on the vendors involved.

Why are post-capture lead costs hard to track?

Post-capture costs are spread across multiple systems and vendors. Validation services, enrichment providers, delivery platforms, and buyers may bill independently and on different schedules. Because those charges do not appear in a single place by default, the full cost of a lead after capture is easy to underestimate unless the data is consolidated.

Do all leads need the same level of validation before delivery?

No. Leads differ in price, buyer expectations, and risk. A low-priced shared lead does not carry the same economics as a high-priced exclusive. Applying the same validation depth to every lead can increase costs without improving routing, acceptance, or revenue.

Which validation checks are legally required?

Legal requirements focus on permission to contact and avoiding known legal exposure. Under federal law, prior express written consent is a central requirement for certain automated calls and texts. Those requirements are defined by FCC rules implementing the Telephone Consumer Protection Act of 1991 (TCPA) and clarified in the FCC’s 2015 Omnibus Declaratory Ruling and Order, which interprets aspects of the TCPA and its consent obligations.

The National Do Not Call Registry is maintained by the Federal Trade Commission (FTC). Sellers and callers subject to the National Do Not Call provisions must comply with FTC rules governing the registry and honoring consumer opt-outs.

How do retries increase validation and delivery costs?

When a delivery or validation attempt fails, systems often retry automatically. If retries repeat the same paid checks, each attempt generates another charge even when no new information is gained. Short outages or transient failures can result in many duplicate checks before the issue is noticed.

Why do buyer coverage changes increase lead delivery costs?

Buyer coverage defines which leads a buyer is willing to accept based on geography or other rules. When those rules tighten, more leads are rejected after processing has already occurred. Validation, enrichment, and delivery attempts may have already been billed by the time the lead is returned, increasing overall delivery cost.

How can lead sellers reduce distribution costs without increasing returns?

Costs can be reduced by focusing on steps that actually affect routing, acceptance, and price. Running buyer coverage checks before expensive validation prevents unnecessary fees. Matching validation depth to lead value limits over-processing. Managing retry behavior avoids repeated charges during failures. These changes reduce waste without lowering lead quality or increasing returns.