How Do I Stop Fraudulent Leads from Reaching My Clients or Sales Team?

Whether you buy or sell leads, keeping fraudulent leads out of your lead distribution is a big part of a sound lead generation strategy. Nothing kills a reputation quicker or makes clients run faster than passing along fraudulent leads.

What’s at risk by passing fraudulent leads?

Lead generation fraud can have a huge financial impact. First, there is the expense of direct marketing. If your budget is $100,000 for leads in a quarter and 20-30% are fraudulent, you pay a direct cost. Buyers will discover fraudulent leads quickly and will terminate your relationship. At the very least, they’ll demand returns, and in the worst case, they’ll be accountable for non-compliance with TCPA. If suspect vendors or affiliates pass along fraudulent leads to you and your company turns around and sells them to your clients, you are taking on an awful lot of risk.

Getting business from a big client is hard; maintaining that relationship over the long term is even more challenging. Take a proactive approach to ensure your leads have expressed legitimate interest and are who they say they are. Here are the top lead fraud prevention strategies to keep your clients happy and your lead generation business thriving for years to come.

Learn how lead distribution software automation can help with your lead hygiene.

1. Duplicate Check

This one seems simplistic, and it can be, but some duplication checks are better than others. One of the ones we like at ClickPoint is to show the original dupe or original duplicate lead provider. Part of fraud prevention is managing your marketing sources; if you identify the origin, you can identify the fraud. Cut off this source immediately because they sell your leads to other lead generation companies, which kills your lead conversion rate and hurts your reputation.

2. Email and Phone Validation

With real-time email and phone validation, you can, at the very least, verify the accuracy of the information you have received from your landing page or a third-party marketing source or affiliate. Email and phone validation is only a step in a sequence of checks you should employ. While these checks can create a score and remove invalid or fake information, they won’t stop fraud by themselves. They will start to give you clues about where the fraud is occurring.

3. USPS Address Standardization

Much like email and phone verification, this step will help ensure you have the correct information on a specific lead before you run additional checks. By checking that the address is valid, you improve your success rate with further checks you may run to authenticate an internet lead.

4. reCAPTCHA

These days it can be challenging to spot bot traffic, and reCAPTCHA can help you prevent bot traffic from ever reaching your lead distribution software. You can deploy reCAPTCHA from Google for free. Essentially, this solution makes the prospect verify they are human on your landing page or form. If you have marketers working on your behalf, you can ask that they use this and pass it along in their lead submission if reCAPTCHA is authenticated.

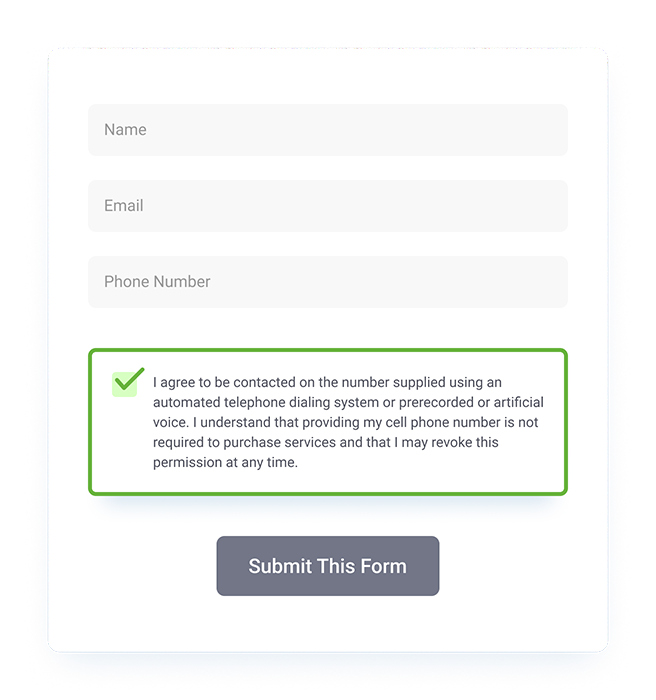

5. TCPA validation

Most lead buyers use a solution like Jornaya to ensure that consumers give express consent before calling them. You can also use TCPA tools provided by ClickPoint or other companies to offer directly on your website or your affiliate’s websites. TCPA validation is the best protection you can get. TCPA validation solutions on your marketing websites confirm intent, geolocate an IP address, and prove a lead has provided consent. Even if there is fraud, it reduces the chance and proves you have made your best effort to capture consent on behalf of the prospect you are providing to your customers.

6. Phone Verification

I like this one a lot. It will cost a little more to hire telemarketers and use a predictive dialer. However, if you are growing and using third parties to augment your lead volume, I consider this the best way to verify your data before selling it. Your call compliance team will run your leads through call qualification with this method. All you need is a simple script to ask the prospect if they are indeed interested and that you will be matching them with the best Lender or Insurance Company etc. You do not have to validate every lead for this to work. You are looking for trends like; 8 out of 10 people you spoke with said they are interested and verified they filled out your form.

Anything less than an 80% score indicates a sub-par affiliate or provider. This kind of peace of mind is invaluable for you and your clients. In fact, in most cases, your clients will pay a premium for you to run this kind of service, and it shows them you are willing to go the extra mile to prevent bad actors from putting them at risk.

If you want to be a lasting business that retains your lead buying customers, you will take data privacy compliance seriously. At ClickPoint, we have worked with over 500 lead generation companies over the past ten years; we know which ones have staying power. The companies that provide a superior internet lead with very few fraudulent leads will always have a much better customer retention rate.

Learn more about lead distribution software.

Perspective from Practice

This article reflects working with lead programs where fraud is not an occasional anomaly, but a structural risk that increases in proportion to scale. As volume grows and affiliates, publishers, or third-party sources are added, fraudulent behavior tends to surface in predictable ways: duplicate submissions, fabricated contact data, recycled traffic, and consent that cannot be substantiated.

At ClickPoint Software, we observe these patterns repeatedly through LeadExec, which is used by lead sellers and buyers to route and audit leads in real-time. Programs that rely on a single fraud check or post-sale refunds often discover issues only after buyer trust has already eroded.

LeadExec is designed to support layered fraud prevention by centralizing intake, validating data before distribution, and tying source information, validation results, and consent artifacts to each lead. This allows teams to identify bad actors early, isolate problematic sources, and prevent fraudulent leads from entering buyer pipelines. When fraud controls are embedded into the distribution system rather than handled manually, lead quality improves, and long-term buyer relationships become defensible.

The broader lesson is systemic. Fraud prevention is not a one-time filter. It is an ongoing operational discipline. Lead businesses that treat fraud controls as part of their infrastructure, not an afterthought, are the ones that retain buyers, reduce compliance exposure, and sustain revenue over time.